The intent of this article is to educate and inform.

During the month of August, the Reston Community Center (RCC), in conjunction with the Center for Survey Research at the University of Virginia is conducting a community survey. This survey will explore how our community residents use RCC programs and services and help determine future offerings.

The programs and services offered by RCC are an important part of Reston’s culture and experience. Some background information on RCC history and funding is in order:

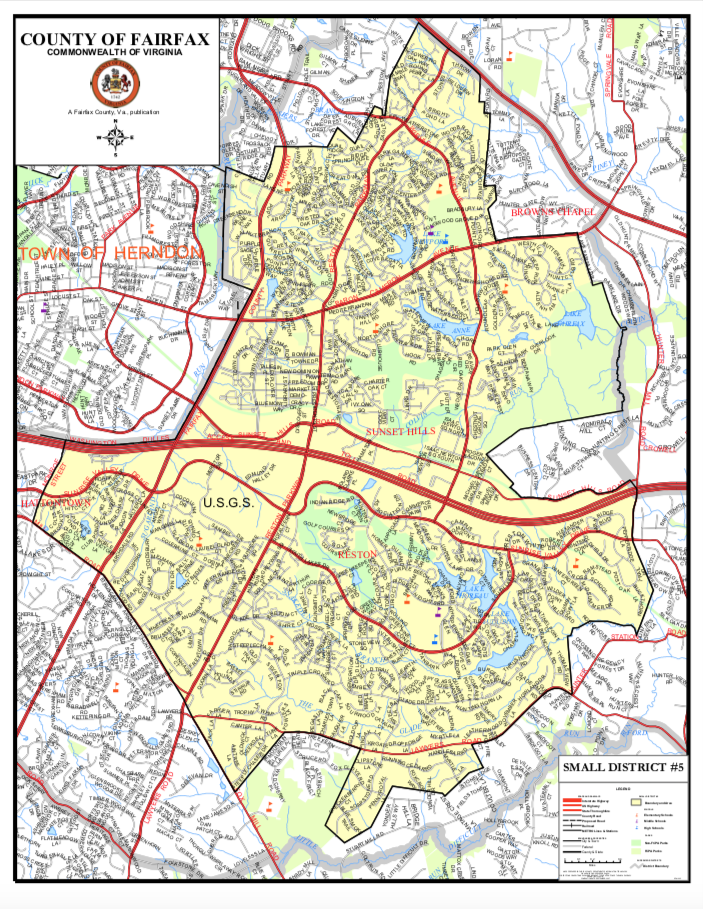

- The Reston Community Center with its two facilities at Hunters Woods and Lake Anne is the result of a special tax on Reston property owners. Begun in 1975 by Fairfax County, the Small District 5 tax was used to construct and now to maintain and operate these community resources and the services they offer.

- The Small District 5 tax is 4.7 cents per $100 of your county property value and is added to your property tax bill.

- It is important to note that this Small District 5 tax is over and above your standard county property tax. In 2019, all Fairfax County property owners paid a base $1.15 tax rate. Reston properties pay $1.197 due to the additional 4.7-cent tax that funds the two locations, programs, and services. There is no contribution from the Fairfax County tax revenues collected from other County taxpayers to cover RCC’s annual expenditures. Reston residents do receive discounted program fees that non-residents do not. More details on RCC and its funding can be found at this County website link:

https://www.fairfaxcounty.gov/budget/sites/budget/files/assets/documents/fy2019/adopted/volume2/40050.pdf - Commercial properties, as well as residential properties, pay this Small District tax. For example, the Hyatt, Home Depot, Boston Properties, all pay this tax of 4.7-cents per $100 of their property value. When a parking lot is turned into a commercial property building, the value of that property obviously changes. For example, when Wegmans opens as part of the coming development south of the toll road near the newest Reston metro station, new revenue will be generated for Small District 5.

- Think long and hard about the long-term implications of your answers to survey questions E6 and E7. If a performing arts center were to come to Reston, it will draw attendance from all over the region, not just Reston. For example, the Water Mine at Lake Fairfax Park attracts visitors from well outside Fairfax County. The same goes for Clemyjontri Park in McLean. A performing arts center is in the Reston Master Plan, but should that mean that Restonians shoulder the full costs?

- Regarding survey question E10: “When property values rise in our area, revenue raised from property taxes goes up, too. If more tax money was available to RCC due to new revenue …”

There is no “if” about it that RCC’s revenue will increase. For consideration as write-ins for answer #4 – Something else (please specify):

- Lower the tax rate, or

- Lower the tax rate for residential properties; maintain it as is on commercial.

The Survey information is on the RCC site here.

Learn more at RCA’s 411 Series page at https://rcareston.org/reston-411/